Why Did My Credit Score Drop? Top 3 Surprising Reasons

How To Take a Financial Timeout Even If You Can’t Afford It

April 21, 2020

3 Money Lessons I Learned From My Mom

May 5, 2020You are working hard to raise your credit score and you think everything is going great! You log in to check your credit score and there you see it…your credit score has dropped by 7, 15, 29, 35, or even 100 points!

Why did this happen? You are doing everything right. You are paying all your bills on time and even paying down debt. All your hard work is not being shown on your credit score. Before we can talk about why your credit score dropped, let’s talk about what a credit score even is.

What is a Credit Score?

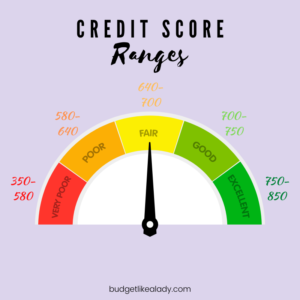

A credit score is a 3-digit number that tells banks and other lenders know how great you are about paying debts. Credit scores range from 300 to 850. The higher the score, the more reliable you are to pay a debt back.

Notice how I said nothing about being debt-free?…hmmmm

Everyone has 3 credit scores. Each score is from a different credit bureau: TransUnion, EquiFax, or Experian. These credit bureaus can calculate credit scores in their own way, which is why all three can be different. Some banks and lenders prefer one bureau over others, but it is by choice. Are you curious to know which your lender prefers? Call them and ask. Most of the time they will tell you which bureau they prefer.

If you are curious to see what your credit is? Go to CreditKarma.com (affiliate link) to see your free credit score.

How are credit scores calculated?

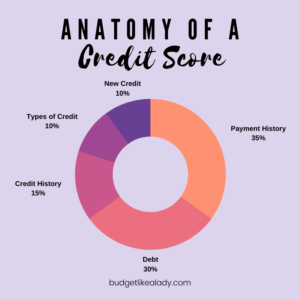

Your credit score is calculated by using 5 factors. Each factor has its own weight when it comes to affecting your credit score.

- Payment History: 35% of credit score. Make sure you pay those bills on time.

- Debt: 30% of credit score. Pay your debt and don’t max it out.

- Length of Credit History: 15% of credit score. The longer you keep paying those revolving debts (like credit cards), the better your credit history.

- Types of Credit: 10% of credit score. The more different types of debt you have (mortgage, credit cards, student loans, etc.), the better the credit score.

- New Credit: 10% of credit score. Opening new credit accounts is not as good as you think…keep reading.

Now that we have a better understanding of credit scores. Let’s talk about the things they don’t tell us when trying to improve our credit score…

Top 3 Reasons Why Your Credit Score Dropped

- You Paid Off a Credit Account

Believe it or not, paying off your debts hurts your credit score. Banks and other lenders want to get as much money as they can from you. When you pay off your credit account, that means the bank can’t get anymore more money from you. You are no longer paying interest fees. That’s not what banks and lenders want to hear. Keeping and paying debts for as long as possible will actually help your credit score.

2. You Closed a Credit Account

Very similar to paying off a credit account, closing a credit account can hurt your credit score. Closing an account affects your credit history. For example, if you pay off a credit card and leave the account open, the open credit card will add to your credit history. The longer the credit history, the better the credit score. Credit history accounts for 15% of your credit score.

3. You Applied for New Credit

There is a myth that checking your credit score too many times can drop your credit score by hundreds of points…not true. The truth is new credit means short credit history. Remember, banks and lenders are looking for people to pay their debt for a very long time…years! If you have new accounts with short credit history, that can make your credit score drop.

New credit double-dips into 2 credit score factors: New Credit and Credit History. Credit history accounts for 15% of your credit score and new credit accounts for 10% of your credit score.

So, becoming debt-free can hurt your credit score. If you are trying to establish credit by opening credit cards, that will drop your credit score before it gets better.

Banks and other lenders want you to be in debt. Being in debt and paying those debts monthly will increase your credit score. If you need a loan to buy a house or pay for college, they keep these things in mind when raising your credit score. Having an 850-credit score should not be the goal if you need a loan, just get a good enough score to have the lowest interest rate on your future loan.