Why I Decided to Invest While Paying Off Debt

FREE Financial Planning Printables

November 14, 2017

What the Experts Don’t Tell First-Time Budgeters

December 5, 2017Estimated Reading Time: 4 minutes

This post was inspired by a few readers who have asked the common question, “Should I pay off debt or invest?” Although there is no black and white right or wrong answer, I can only tell you what worked best for me and my family. While paying off debt, I chose to continue to save and invest…for the most part.

There was a time that I stopped saving for our savings goals to get some big debts out of the way. I am sure you have heard that you need to be debt free before you start saving or investing. But what if you still want to save for unplanned emergencies, get the most out or your retirement savings, and invest for your kids’ future that will be here sooner than you think? Are there any benefits to paying off debt vs saving? Here is my method to the madness.

Not All Debts Are Created Equal

You may have heard of good debt vs bad debt. Usually good debts are considered to be mortgages or students loans, things that can “increase in value (appreciation)” over time. Bad debts are considered to be car loans, personal loans, and credit card loans, things that “decrease in value (depreciation)” over time.

Although good debts and bad debts may be the deciding factor for you, it definitely was not for me. I focused more on high interest vs low interest rates while paying off debt. My high interest rate accounts included credit cards and personal loans, anything that had a 8% interest rate or higher. My lower interest rate debts were not top priority to me. GASP…I know…

I stopped our savings until all of the high interest rate debts (8% or higher) were paid off. After that, I continued to save and invest while I was paying off the low interest rate debts.

Why 8% Interest was My Magic Cut Off Rate

So, why did I choose 8% as the magic high-low interest rate? It came down to doing the math. The average rate of return for retirement and investment accounts is between 8% and 10%. If I were to focus on my debt that was charging me 2.5% interest (aka my student loans), I would be losing AT LEAST 5.5% of my return every year by not investing. Plus for every year that it takes me to pay off these low interest rate debts, I am losing on compounding my interest!

Quick tip: Compounding interest is the money that your money makes for you, so you earn money on top of money… In other words, your money is making you more money.

Let’s do the math

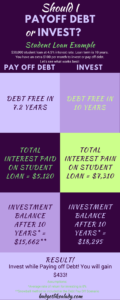

Using student loans as an example, we will see what decision will make us more money with a student loan that’s $30,000 at 4.5% interest. What if I had an extra $100 per month to pay off debt or invest? The average student takes 10 years to pay off student loans. If you decide to save the money in an investment account, after 10 years you could have $18,295 (remember, you only put in $12,000 of your own money). If you decide to pay off your student loan first and then invest, you will pay off your student loan in 7.2 years and have $15,662 in your investment account within the same 10 year time. In the end, you GAIN $433 by investing while paying off debt!

What was My Result?

Currently, I am debt free. Read How I became debt free here. Deciding to pay off debt while saving was the best decision for us during our financial freedom journey. In that time, we had our first child, I experienced a job lay off, and we some unexpected traveling for funerals which you cannot put a dollar figure on. Not to mention that my retirement investments grew at a 12% rate of return! I can’t imagine losing out on all that money compounding interest!

I always suggest making financial decisions that work best for you and your family. There is no financial expert out here that can tell you how to live your life and what to do with your money. You are the best manager for your money. Make a plan, set some goals, and achieve!

What conventional money method have you chosen to go against during your financial freedom journey?

8 Comments

When I attended FinCon last month, I ran my FIRE plan by people who retired early. All of them said I was nuts for paying off debt and not investing at the same time. Investments are the key to building wealth and actually retiring early. In fact, many early retirees still hold onto their debt. That’s a tough pill for me to swallow, since I prefer the freedom and peace of mind of being debt-free, but I’m starting to dip my toes more into investing.

Many people would consider investing while paying off debt to be a big “no-no”. But if you do the math, you could gain more money in the end.

I think for people who lack a plan or have a huge spending problem paying off debt first is probably safer, but for someone who has it all together and is as obviously bright and focused as you are then following the math is smarter. You made a good argument for that and the fact that it has worked for the winners you ran it by is the best evidence of all. Really nice post!

Thank you!

We decided not to invest while we were paying off debt. It worked for us and our investing is going well. We choose to not dwell on the compound interest that we missed out on by not investing. As much as we like to calculate stuff I don’t recall this being one of the things we chose to calculate. Lol. Ultimately I think it’s fine to do it either way as long as you have a solid plan. It’s nice that investing while having debt worked out for you and your family.

I agree. The focus is accomplishing a goal in a way that works best for for family. Congrats on the debt free journey!

I’m doing both. I chose to max out my 401K instead of paying that money to my student loan. With the way my returns are set up I don’t regret it one bit.

Awesome!