How to Raise Your Credit Score like a Boss

Roth vs Traditional IRA: Retirement Basics

January 17, 2017

Side Hustles I Have Tried that Actually Make Money

January 24, 2017

Credit scores are a necessary evil. If you need a loan for school or any big purchase, you need to have a good credit score. If you are looking to raise your credit score, I have come up with 5 steps that will help you do so. It is no secret that I do not like the credit scoring system. Credit scores are designed to keep people in debt. It is important to raise your credit score wisely and not go into more debt doing so.

I came up with these 5 steps when my identity was stolen 15 years ago. I did not know anything about credit scores or reports but I had to learn fast: I had to repair my credit. The damage was done and I had no idea because I did not know there was an ongoing report about all of my accounts. I would like to share my lesson learned with you.

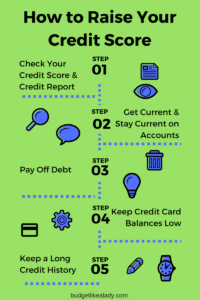

Step 1: Check Your Credit Report

If you want to raise your credit score, you need to know your starting point. What is your credit score? Is your information correct on your report? Do you have any delinquent or overdue accounts?

You can get your credit report from a reputable credit company. Here are some affiliate links where you can download your credit report:

Step 2: Get Current and Stay Current

When you are raising your credit score, you cannot have any delinquent accounts. If you notice on your credit report that you have overdue accounts, pay them. If the balance is too high to pay in-full, call the creditor, or collections agency, to negotiate a lower payment or get on a payment plan on your overdue accounts.

It is important to know, just because you pay off the overdue account does not mean that it will be removed from your credit report. Paying the account will help increase your credit score and the account will display on your credit report as “closed” or “paid”.

Make sure you stay current on all of your accounts. Set up automatic bill pay so you do not miss anymore payments.

Step 3: Pay Off Debt

I know you read my rant in the beginning of this post about how credit scores are designed to keep you in debt and now I am saying to pay off your debt to raise your credit score. Make up your mind, Nicole! Hear me out, in order to raise your credit score; you must reduce your debt. This is making room for you to accumulate more debt. Get what I am saying? Creditors want to know that you have enough money to pay them back so you need to free up some cash to prove that you can pay them.

Step 4: Keep Credit Card Balances Low

Unfortunately, on your credit report, revolving debt such as credit cards is a good thing. It is a creditor that you can pay every month. When raising your credit score, keep these balances low. I recommend not exceeding 30% use of your credit limit.

Step 5: Know Your Credit Length History

Credit history length is important when raising your credit score. Keep your credit card accounts open. If you need to close some credit card accounts, keep the cards with the longest history. Credit card accounts that have been open and current for years will increase your credit score. It shows that you are loyal and pay your debts for an extended period of time. This is important when applying for a mortgage or car loan.

Do not open new accounts trying to establish credit. If you have no credit, then open 1 credit card to help build credit. If you already have credit established with credit cards and other accounts, do not open any new accounts. The new accounts can hurt your credit score since you would have no history established with the new creditor.

Proverbs 15:22 – Without counsel plans fail, but with many advisers they succeed.