4 Awesome Reasons Why I Love YNAB for Budgeting

Top 3 Reasons Why Every Budgeter Needs a Tracking System

September 29, 2020

Make the Best Budgeting Routine to Keep Your Money in Check

January 5, 2021YNAB for budgeting…is it right for you?

Financially savvy people need to know how to track their money to see where it goes and how close you are to reaching your goals. Not only does tracking your budgeting provide accountability, but it makes sure you are on your way to achieving your goals!

Have you experienced this?

You want to buy a house so you start researching, “how much house can I afford?”

You come across all of these calculators and spreadsheets and you are still not sure if you can afford your dream home.

Here’s the thing, when you know how much room there is in your budget, it’s much easier to know how much you can afford. You don’t want to pay too much and realize all you do is work to pay for something you cannot afford.

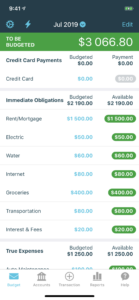

What is YNAB?

YNAB is short for You Need a Budget. According to their website, they are an award-winning software that helps you gain control of your money. YNAB is a budgeting app/software that allows you to track your income, spending, and savings all in one place.

YNAB prides itself on being a proactive system that requires you to be intentional with your money. By doing this, you will be able to make better decisions about your money.

Want a 34-Day Free Trial for YNAB? Click here to use my referral link.

Here are my 4 reasons why I use YNAB for budgeting:

Reason #1: It Saves Time

Once you get in the habit of using YNAB, you will see how much TIME you SAVE when using it consistently. The auto-categorizing feature makes it EASY to input expenses.

For example, the first time you tell YNAB that a purchase made at Aldi belongs in the grocery category, YNAB will remember that and auto-categorize all future purchases made at Aldi as a grocery expense. This feature helps me maintain my budget in less than 15 minutes per week!

Reason #2: Easy Goal Tracking

YNAB makes it easy to track your money goals! Whether your goal is to save $500 by Christmas or $5000 in 2 years, you can set that goal in YNAB along with an end date and YNAB will track it for you!

Don’t take my word for it…my clients that have irregular income LOVES this feature! You can set monthly goals for expenses to make sure they are always covered.

Want a 34-Day Free Trial for YNAB? Click here to use my referral link.

Reason #3: Painless Way to Share with Spouse

Between me and my husband, I am the main money manager for our family. I do the day to day things like track expenses and check account balances but when it comes to big purchases or long-term goals, those are a joint effort. It has not always been like this. It took many years for us to get on the same page about our money.

Back in the day when we budgeted on paper and/or spreadsheets, it was difficult for us to have real-time information about our budget. Since signing up for YNAB many years ago, it makes it SO SIMPLE to share finances with each other by desktop, laptop, or phones.

Reason #4: Fun Graphs and Charts

I confess I LOVE looking at easy to read graphs and charts. It gives me a pretty visual instead of looking at just numbers all the time. YNAB has some nice charts to look at so you can track your progress visually. Whether you are watching your net worth increase or watching your debt amount decrease, those charts and graphs give you a picture to go with all your hard work.

And guess what?!?! You don’t have to make them! These charts and graphs are premade for you and can be seen at a click of a button.

What do you think?

Is YNAB a good budget tracking option for you and your family?

Comment below and let me know what your biggest takeaway was and what action step you’re going to take now that you know a little more about YNAB for budgeting.

Want a 34-Day Free Trial for YNAB? Click here to use my referral link.