Slay Your Fear of Losing Money in the Stock Market

No More Surprise Bills! How to Plan for Unexpected Expenses

August 21, 2018

Top 5 Money Myths Banks Want You to Believe

September 20, 2018Estimated Reading Time: 5 minutes

The thought of losing money in the stock market can be terrifying. It’s not just about losing money, it’s about feeling like a failure which can stress you out. Investing in the stock market does not have to be this scary thing that only rich people do. Anyone can start investing at any time in their life.

Investing is the best way to build wealth without monopolizing your time like a job does. When you are at work, you only get paid a certain amount for the time you are working. In investing, “technically” you can make money while you sleep. I’m sure that sounds like a dream but it does not mean there is no risk for an awesome reward.

I want to show you some ways I got over my fear of investing in the stock market and I think it will help you too.

Learn the Basics of Investing

You don’t need a finance degree to build your knowledge about the stock market. I know there are a lot of scary terms in the investing world such as capital gains (or losses), asset allocation, bear market, and more but you don’t have to know every term when you want to start investing. So, don’t think you need to have expert knowledge when investing.

Investing as a beginner can seem overwhelming but I want you to know that it is not as hard as the world makes it seem. You will not become a millionaire overnight (I don’t care what the late-night infomercial said) but you can become a millionaire with time and strategy while investing in the stock market.

Know Your Investment Goal

When coming up with an investment strategy, you need to know your goal. Since you are a beginner investor, I recommend your first goal be retirement savings. Opening an Individual Retirement Account (IRA) is easy and can be done online or at most banks. IRA’s give you the option of investing in stocks, mutual funds, bonds, and cash. IRA’s are the perfect vehicle to start your investing journey.

If your goal isn’t retirement, I still recommend focusing on a long-term goal. Make sure your goal takes at least 5 years to achieve if you are going to invest in the stock market and I will show you why.

Focus on the Big Picture

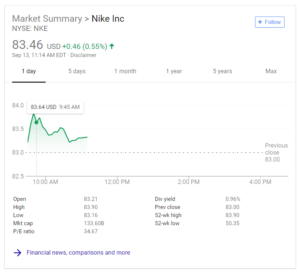

When investing in the stock market, it is best to invest for the long-term. Honestly, the day to day of the stock market is like a roller coaster and can be scary if you watch it daily. Let’s take a look at Nike Stock, here is a 1-day market summary:

As you can see, Nike’s stock value is falling on this day. If you only look at this day, then you would think you are losing money. Que the tight feeling in your chest…

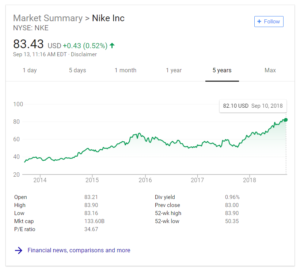

Now let’s take a look as if we owned Nike stock for the last 5 years:

As you can see, Nike stock value has GAINED tremendously in the last 5 years. So, the little loss that it takes in one day is nothing compared to the gains in the last 5 years. This is why I recommend investing in the stock market for the long term.

FULL TRANSPARENCY: stocks are risky, you are putting your money only on ONE company. If you are looking for more diversity, try investing in mutual funds they are a group of stocks in one bundle. Mutual funds are less risky than individual stocks because the stocks in the group can balance each other out. If one stock is performing badly, there are a group of other stocks that could be performing great.

Build Confidence

Seeing that one-day loss can still give someone the feeling of anxiety, or at least it did for me so I had to find a way to build my confidence so I can trade without fear. I found FREE Stock Market Simulators!

These Stock Market Simulators are a great stepping stone before actually investing in the stock market. You start with investing with virtual cash (not your own money) and you can test your trading skills with real market numbers and outcomes. These simulators do not guarantee that you will gain money in the stock market, but it will boost your confidence when buying, selling, and trading stocks.

Some Stock Market Simulators I recommend (no affiliation):

Jump in and Start Small

After building your confidence, now it is time to start investing in the stock market. Don’t start investing your entire life savings, start small and learn the ropes. Although the stock market simulators are great, there is no substitution for the feeling of investing your own money. I recommend starting with the investment minimum, depending on the bank (or stock purchase price) this can be anywhere between $50 and $3,000.

Start with an amount that you are willing to lose. Starting with money that you don’t NEED will overcome the fear of losing it. Even if it is only $10 a month, invest it and see what happens.

Fight the Discouragement

Getting over the fear of investing in the stock market is the biggest part of the battle. Once you can get over your fear and start investing for the long term, your future will be bright and financially stable. Remember, this is about financial freedom, leaving a legacy, and showing our children how to build wealth.

What fears did you (or do you currently need to) overcome to start investing?

As always, if you enjoyed this post, please share it with others so their families can benefit from building wealth.

5 Comments

Great post, this is a much needed message for the people I am trying to reach. A lot of the millennial African Americans I have met with as a Financial Advisor are very risk averse and think they have to start with a large amount of capital.

Thank you! I completely agree that the African American community needs to invest more.

Investing in stocks does require this “lack of fear” where you don’t get too conservative. Just see what stocks are performing well historically and put the money out there. A good balance is what you should aim for rather than going the risk-averse route. The same cannot be, however, said for crypto as I found the hard way. Put a huge load into it early this year and found out that the taxation is brutal on it where I live.

Thank you for this insight! I haven’t dug too deep into cryptocurrency yet. It is still on my to-do list. I have to check out the taxation for my area. Thanks!

[…] Budget Like a Lady […]